Tesla’s Q2 Deliveries Fall Less Than Expected Due to Price Cuts and Incentives

Tesla reported a smaller-than-anticipated 5% decline in vehicle deliveries for the second quarter, aided by price reductions and incentives that offset a decrease in demand. This marks the first instance of consecutive quarterly declines in Tesla’s deliveries. Despite this, shares surged over 10%, reaching their highest level in nearly six months.

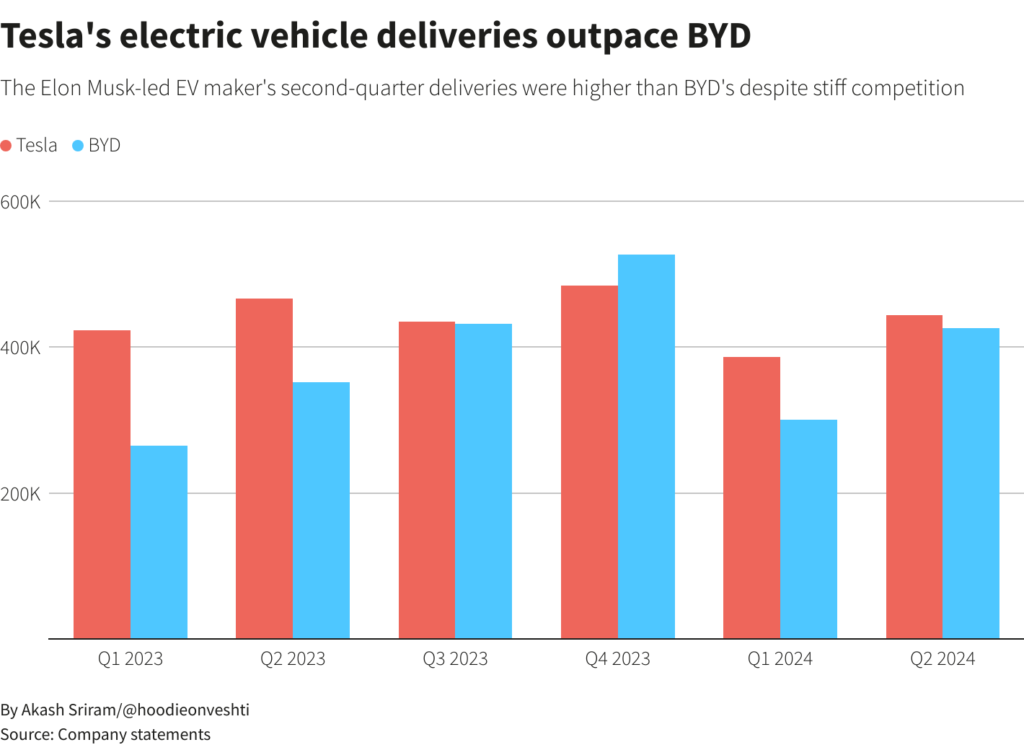

Analysts noted stronger-than-expected sales in China and the United States. CFRA Research analyst Garrett Nelson mentioned that the higher delivery numbers helped alleviate concerns about weakening demand for electric vehicles (EVs). Tesla handed over 443,956 vehicles in the quarter ending June 30, slightly higher than the 438,019 vehicles expected by Wall Street. This included 422,405 Model 3 and Model Y units, and 21,551 units of other models like the Model S, Cybertruck, and Model X. During this period, Tesla produced 410,831 vehicles.

While some analysts view the rebound and delivery figures as a positive sign ahead of Tesla’s robotaxi reveal in August, others are concerned that Tesla’s strategies, such as price cuts and incentives, may be losing effectiveness.

Tesla’s delivery figures showed a 4.8% year-over-year decline but a 14.8% increase from the previous quarter. Despite headwinds, shareholders overwhelmingly supported CEO Elon Musk‘s $56 billion pay package, believing it essential for retaining and motivating him. Musk highlighted that the stock rally is minor compared to the potential impact of Tesla’s autonomous vehicles and humanoid robots.

China

Although Tesla does not provide regional sales breakdowns, analysts suggest that strong sales in China and the U.S. contributed to better-than-expected results. In April, Tesla implemented further price cuts in key markets and offered attractive financing options, including zero or near-zero interest loans in China and the U.S. Additionally, leasing plans in the U.S. made Tesla vehicles eligible for significant federal credits.

In China, domestic sales and exports fell 17% year-over-year in the second quarter. Meanwhile, European sales dropped 36% in May, primarily due to reduced EV subsidies and decreased demand from fleet operators.

The Drop in Sales Reflects Heightened Competition in the EV Market

The recent decline in Tesla’s sales highlights the intensifying competition within the electric vehicle (EV) market. Although the overall sales of EVs are on the rise, the industry’s growth rate has been slower than anticipated. This has led investors to demand higher profitability from each car sold.

Other automakers reported strong sales in the second quarter. Rivian’s vehicle deliveries rose about 9% year-over-year, GM’s EV sales increased by 40%, and both Hyundai and Kia posted gains.

Headwinds

This period marks the first time Tesla has seen a year-on-year sales decline for two consecutive quarters. While Musk anticipates increased deliveries in 2024, Wall Street remains skeptical, forecasting a potential drop due to poor sentiment around EVs. Tesla has revised its growth expectations, abandoning its goal of delivering 20 million vehicles annually by 2030 and instead focusing on new models based on existing platforms. Musk has also promised more affordable models by late this year and emphasized a shift towards self-driving technology, though some investors remain doubtful about its near-term feasibility.

Tesla shares were up 7.7% to $226.11 on Tuesday afternoon but have fallen about 9% this year.

Don’t miss out on these :

UFC 303 Full results : WATCH VIDEO – Alex ‘Poatan’ Pereira reigns supreme

NASA’s Indian-origin Astronaut Sunita Williams stuck in Space

USA Presidential Elections : Joe Biden vs Donald Trump

NVIDIA Launches Nemotron-4 340B: A New Era in AI Development