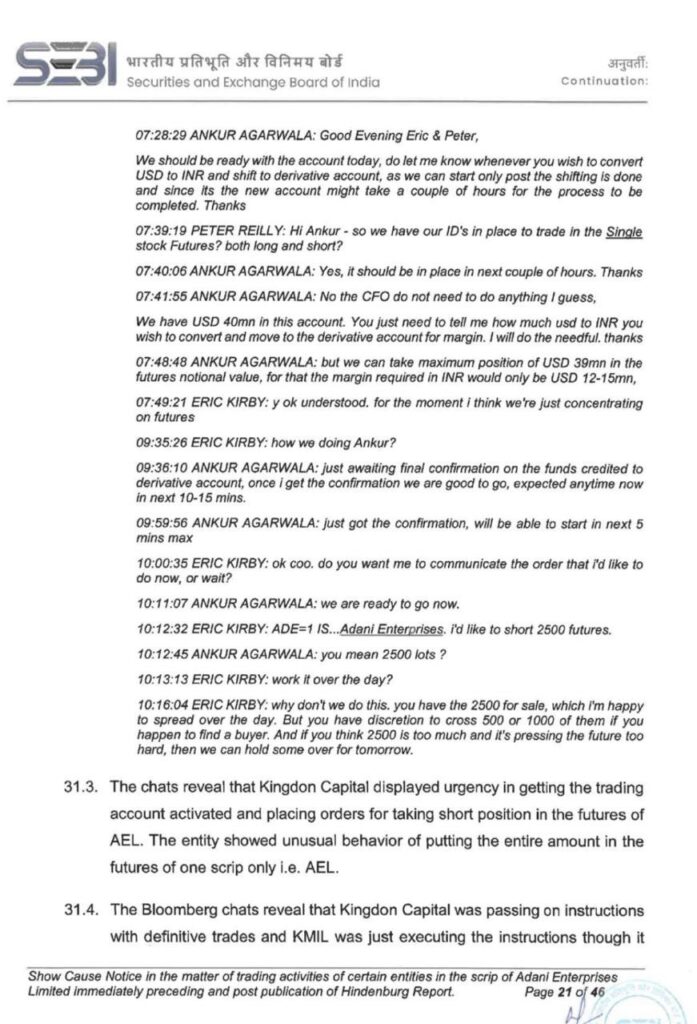

According to Hindenburg Research on July 2, the SEBI show cause notice states that the gains related to Adani shorts amounted to $4.1 million.

Hindenburg had published malicious report on Adani Group. Hindenburg Research disclosed on July 2 that it earned approximately $4.1 million in gross revenue from gains related to Adani shorts through its single investor relationship for the Adani thesis, according to a SEBI show cause notice. Additionally, the firm garnered about $31,000 from its own short position on Adani US bonds, a smaller stake.

Media reports had previously suggested multiple investor partners for Hindenburg, collectively gaining hundreds of millions. However, the SEBI show cause notice clarified that Hindenburg maintained just one investor relationship for the Adani thesis, consistent with their usual practice.

Despite potential financial outcomes potentially breaking even after factoring in legal and research costs, Hindenburg emphasized the significance of their Adani research as their most fulfilling work. The blog underscored that the research was undertaken without financial justification, entailing significant personal risk, yet it stands as their proudest accomplishment.

Furthermore, Hindenburg Research confirmed receiving a 46 page show cause notice from SEBI on June 27 regarding its Adani report. The blog post reiterated that Hindenburg openly disclosed its short position on Adani shares, encouraging readers to consider any potential bias arising from the firm benefiting from a decline in Adani shares.

Disclaimer: Please note that the views and recommendations expressed above belong to individual analysts, experts, and broking companies, and do not reflect the opinions of Time Square Zone. We encourage investors to seek advice from certified experts before making any investment decisions.

WATCH MORE: